In July, the US Department of Commerce reversed a temporary ban on ZTE trading with US component manufacturers, much to the relief of China's smartphone industry as a whole.

Our statement on #ZTE and the escrow agreement: pic.twitter.com/w0Bbej1mAU

— U.S. Commerce Dept. (@CommerceGov) July 11, 2018

It isn't the most ridiculous thing to suggest the reason behind the ZTE Denial Order may have been simple trade protection, or related to the pending 5G scramble (with shots fired in Australia already).

Whatever the cause, Chinese smartphones account for only 3.64% of all US web traffic in our data. Let's take a look at the bigger manufacturers and how popular they are in the USA in 2018.

ZTE

We commented on the "ZTE is suspect tech" issue back in May, and the story has changed quite a bit since then.

Peace appears to have been restored for now, but given the pace of change in US politics at the moment, nothing is set in stone.

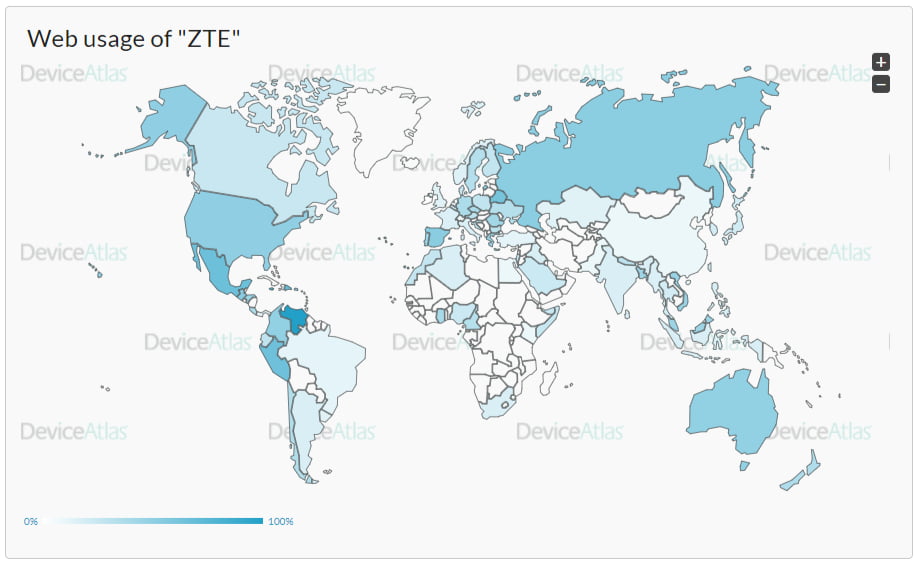

When compared to the rest of the world, ZTE has very small market penetration in the USA, with 0.99% of total web traffic during Q2 2018, making it America's 10th most popular smartphone vendor.

The most popular ZTE devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | ZTE Zmax Pro | 0.189% |

| 2 | ZTE Max XL | 0.115% |

| 3 | ZTE Blade X Max | 0.071% |

| 4 | ZTE Majesty Pro Plus | 0.051% |

| 5 | ZTE Maven 3 | 0.051% |

ZTE is most popular in Venezuela, enjoying 8.5% market share.

Alcatel

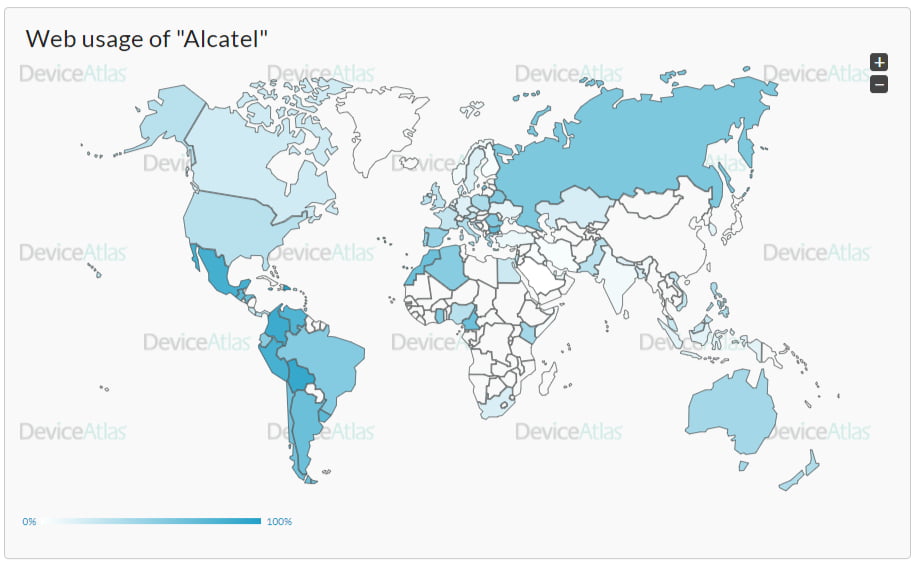

Alcatel hasn't made much of an impact on the US landscape yet, with a tiny 0.27% market share placing it 16th on the overall list of popular vendors.

The most popular Alcatel devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | Alcatel A30 Fierce | 0.046% |

| 2 | Alcatel Revvl | 0.037% |

| 3 | Alcatel Fierce 4 | 0.027% |

| 4 | Alcatel A577VL | 0.014% |

| 5 | Alcatel Raven | 0.013% |

Central and South America are a little more fond of Alcatel devices than the US, with the Chinese-owned French brand enjoying 4.41% share in the Dominican Republic, 3.33% in Bolivia and 3.01% in Colombia.

Huawei

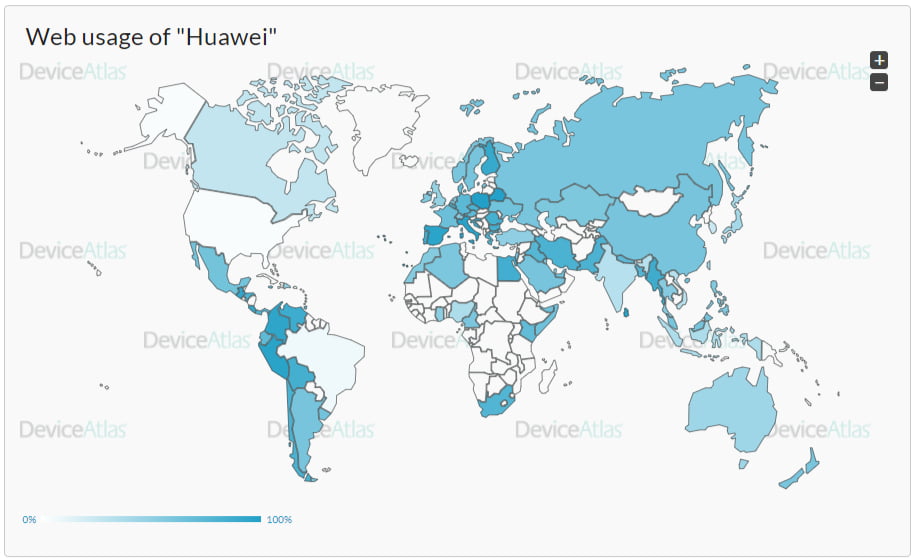

With only 0.12% web-traffic share in the USA, the map below tells the story of Huawei's priority markets.

The second largest phone manufacturer in the world, Huawei has spread its net across the globe, seeing a gap outside the US for high-end devices beyond the traditional Apple/Samsung duopoly. Just as well, as they were also under investigation by the Justice Department for violation of US export and sanction laws.

The most popular Huawei devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | Huawei Honor 6X | 0.017% |

| 2 | Huawei Ascend XT | 0.0165% |

| 3 | Huawei Mate 9 | 0.008% |

| 4 | Huawei Honor 5X | 0.007% |

| 5 | Huawei Honor 8 | 0.006% |

In Poland, 1 in every 6 smartphones - 17.09% - is a Huawei. In Belarus, it's 16.57%. In Italy, 15.89%, Spain 14.86%. The numbers remain strong as we go down the list.

Lenovo

While their smartphones haven't made much of an impact on the US landscape, with just 0.01% traffic share in Q2, Lenovo's diverse product range has seen them grow to revenue of over $45 billion in 2017/18.

The most popular Lenovo devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | Lenovo S60 | 0.002% |

| 2 | Lenovo Vibe K5 | 0.0008% |

| 3 | Lenovo Phab 2 | 0.0006% |

| 4 | Lenovo Phab 2 Pro | 0.0002% |

| 5 | Lenovo P2 | 0.0002% |

Lenovo also make computers and laptops, smart TVs, apps and wearables, but their smartphones are most in use in Ukraine (5.6%), Belarus (5.32%) and Bulgaria (4.26%).

Motorola

Motorola is synonymous with developments in mobile technology throughout the 2000's, with some iconic handsets and innovations still proving popular today.

A healthy 2.05% share in the US - which is hugely dominated by Apple and Samsung - gives them a firm foothold in the market.

The most popular Motorola devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | Motorola Moto Z | 0.315% |

| 2 | Motorola Moto E4 | 0.242% |

| 3 | Motorola Moto Z2 | 0.206% |

| 4 | Motorola Droid Turbo | 0.193% |

| 5 | Motorola Moto Z Droid | 0.161% |

Motorola smartphones are most popular in Latin America, where it enjoys 14.8% share in Brazil, 11.17% in Argentina, 7.36% in Colombia and 6.19% in Mexico. It's also the 7th most popular device manufacturer in India with 3.43% of overall traffic in our Q2 data.

8 Ways to Boost Conversion Rate on Mobile

Download the free guide to learn about the best practices to get the most out of your mobile channels.

- How to build mobile optimized navigation, product filters, forms and CTAs.

- When it's okay to show less content on mobile devices.

- Why you need device awareness to truly optimize conversion rate on mobile.

OnePlus

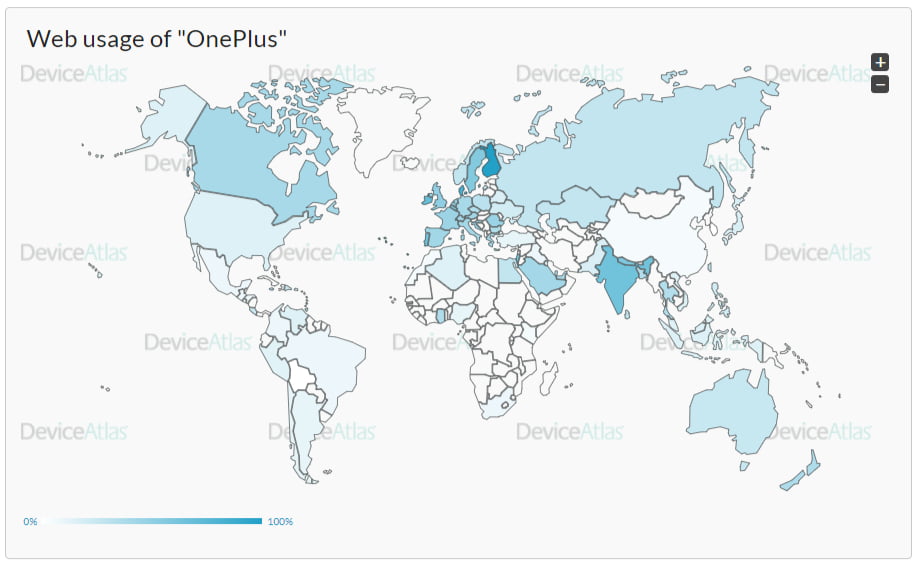

Relatively new to the game, OnePlus was founded in December 2013 in Shenzhen, and hit revenue of $1.4 billion in 2017.

In the USA, it's still early days for the Chinese manufacturer. With only 0.07% market share in Q2 2018, OnePlus may find it difficult to break into the top 20. Unless, of course, competitors get removed from the equation.

The most popular OnePlus devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | OnePlus 3 | 0.023% |

| 2 | OnePlus 5T | 0.017% |

| 3 | OnePlus 5 | 0.014% |

| 4 | One Plus One | 0.007% |

| 5 | OnePlus 2 | 0.003% |

OnePlus doesn't feature strongly in any country, with Finland (3.9% share) top of the list.

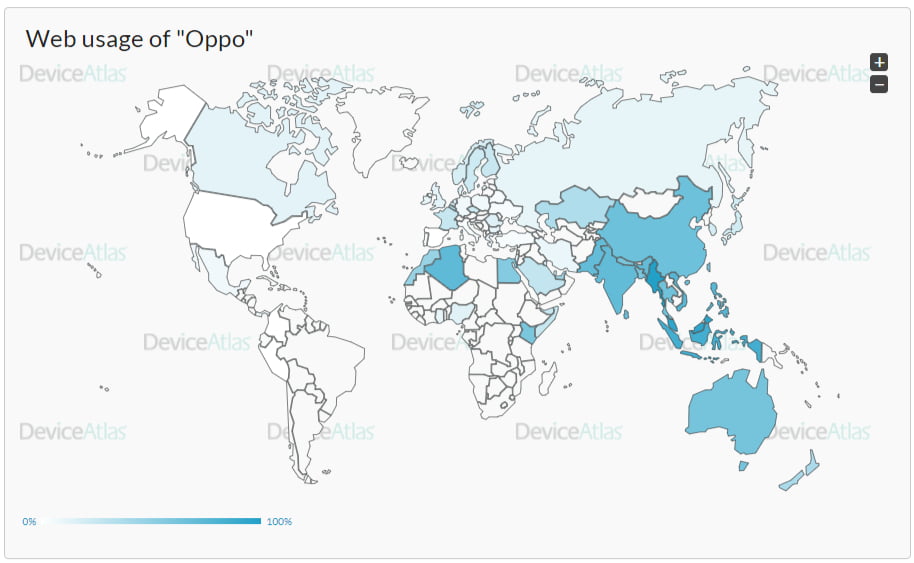

Oppo

Another Chinese manufacturer yet to make an impact on the US landscape is Oppo, who claim 0.01% of US traffic share.

The most popular Oppo devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | Oppo F1s | 0.0009% |

| 2 | Oppo A37 | 0.0008% |

| 3 | Oppo A57 | 0.0005% |

| 4 | Oppo A37f | 0.0004% |

| 5 | Oppo A83 | 0.0003% |

Despite this, Oppo was the top smartphone brand in China in 2016, and ranked 4th worldwide. Some numbers from our Q2 data back up this claim, especially in South East Asia.

Oppo enjoys 19.29% market share in Myanmar, which experienced a mobile revolution in 2013, when the state monopoly over phone services was ended. Numbers are also strong in Malaysia (15.58%), Indonesia (10.37%) and Singapore (9.64%).

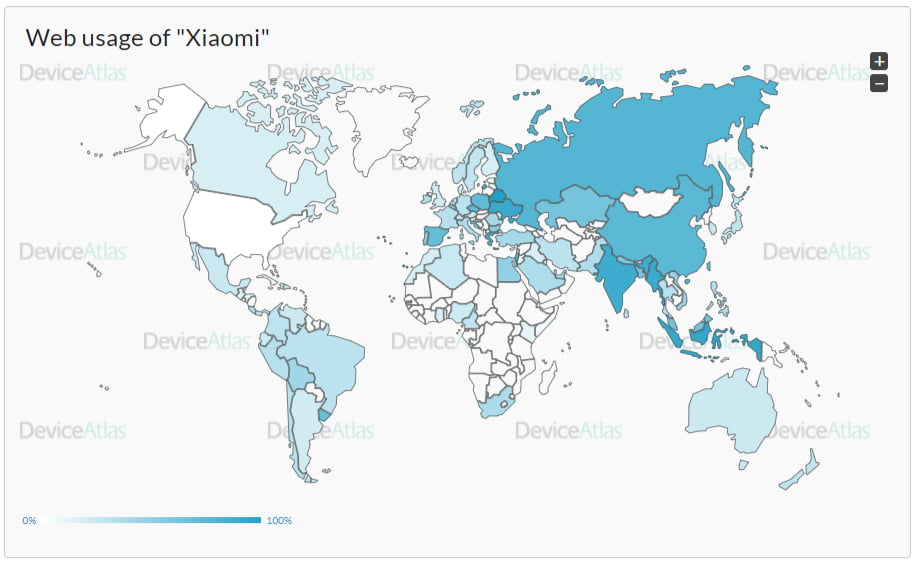

Xiaomi

Currently the world's 4th largest smartphone manufacturer, Xiaomi have been releasing some impressive devices recently, but still haven't made a dent on the overall US market.

With only 0.02% share, they're the USA's 30th most popular smartphone manufacturer. Despite this relative anonymity, rumours were rife that Xiaomi would run into the same issues as ZTE and Huawei, namely being suspected of spying for the Chinese government, and thus denied a fair crack at entering the race.

The most popular Xiaomi devices in the US are:

| Rank | Phone model | Traffic Share |

|---|---|---|

| 1 | Xiaomi Redmi Note 4 | 0.0035% |

| 2 | Xiaomi Redmi 4X | 0.0014% |

| 3 | Xiaomi Mi A1 | 0.0013% |

| 4 | Xiaomi Redmi Note 3 | 0.0012% |

| 5 | Xiaomi Redmi Note 5A | 0.0010% |

Xiaomi's founder and CEO, Lei Jun, might not care too much about the US market given his success elsewhere (and also the fact he's China's 11th richest person). With a 19% market share in Belarus, 14.12% in Indonesia, 11.77% in India, 7.44% in Russia and 6.51% in China, things are going in the right direction.

Why does the US fear Chinese smartphones?

Given the low numbers of Chinese smartphones active in the US market, we can probably rule out trade protection as the driving force behind the investigations into ZTE, Huawei and whoever else popped up on the radar.

Other manufacturers present in the US include Coolpad, Gionee, Hisense, LeEco and Tecno Mobile.

Combined, these Chinese-made smartphones accounted for only 3.64% of US traffic in our data. That points to something else being the cause.

Perhaps the headlines - breaking trade sanctions and the possibility of backdoors built into Chinese devices - aren't quite as far fetched as we instinctively assumed.

Also, an effective tariff war would require a sound knowledge of economics and the complex supply chain of smartphone manufacturing, which, as John Oliver explains, may not be the case:

Download the latest Mobile Report

Bringing you the latest developments on the global device landscape.

All statistics represent the share of web traffic in selected countries based on mobile visits tracked by DeviceAtlas.